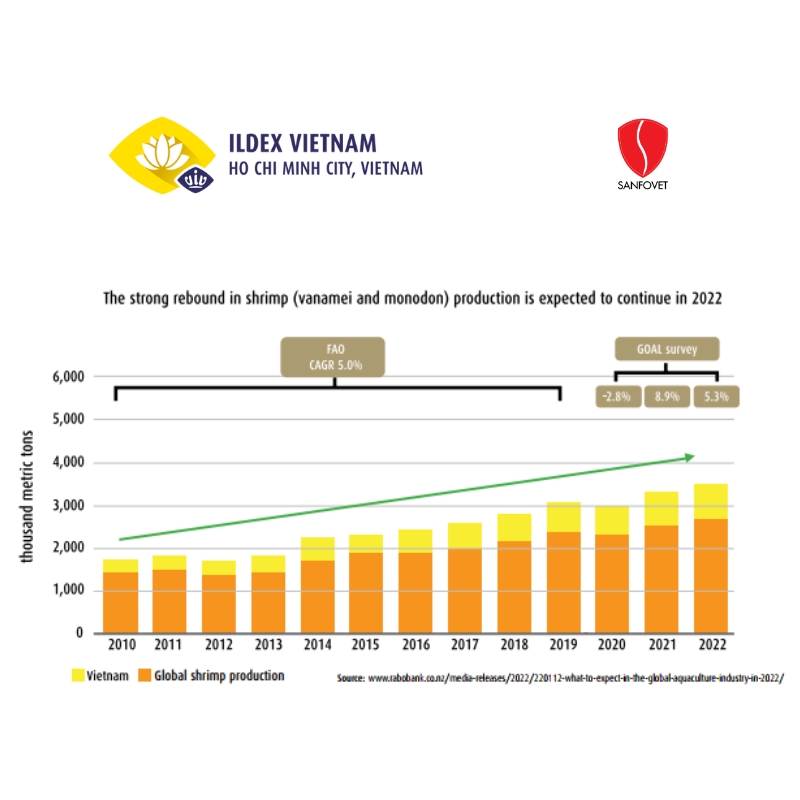

In recent years, the Vietnamese livestock market has witnessed solid growth, reflected in the high demand for livestock feed and materials and livestock product exports. However, this sector faces numerous challenges and opportunities, from fluctuations in raw material prices to addressing intermediaries to improve the connection between production and the market more effectively.

In the first six months of 2023, Vietnam imported 8.2 million tons of livestock feed and materials for the livestock feed market, equivalent to 3.4 billion USD, a decrease of 3.3% in volume and 7.9% in value compared to the same period in 2022. The reduction in the price of livestock feed materials on the global market and reduced transportation costs are positive signals for the industry. Diseases, such as African Swine Fever (ASF), have previously caused severe damage to the pig farming industry, reducing domestic consumption and output.

The livestock feed sector is expected to experience the fastest growth with the increase in domestic farming and changes in dietary patterns. The demand for livestock feed materials in Vietnam is forecasted to reach about 28-30 million tons/year in the next five years, valued at 12-13 billion USD, with an average growth of 11-12%/year.

In the first 11 months of 2023, they recorded impressive growth in the export value of livestock products, estimated at 402 million USD, an increase of 22% compared to the same period in 2022. Exports of milk and dairy products increased by 26%, while meat and animal by-products increased by 36.4%. Notably, the export of meat and edible by-products of poultry strongly increased, valued at 10.55 million USD, up 250.5% in volume and 315.6% in value compared to last year.

One of the market's shortcomings in consuming livestock products is the connection between production and the market, where intermediaries earn the most profit. The Department of Livestock Production has identified this issue as a challenge that needs to be addressed by organizing activities to facilitate market circulation.

Overall, the Vietnamese livestock industry is on a development path with many opportunities opened thanks to the growth of the domestic and international markets, despite facing many challenges from fluctuations in raw material prices, disease, and intermediaries.

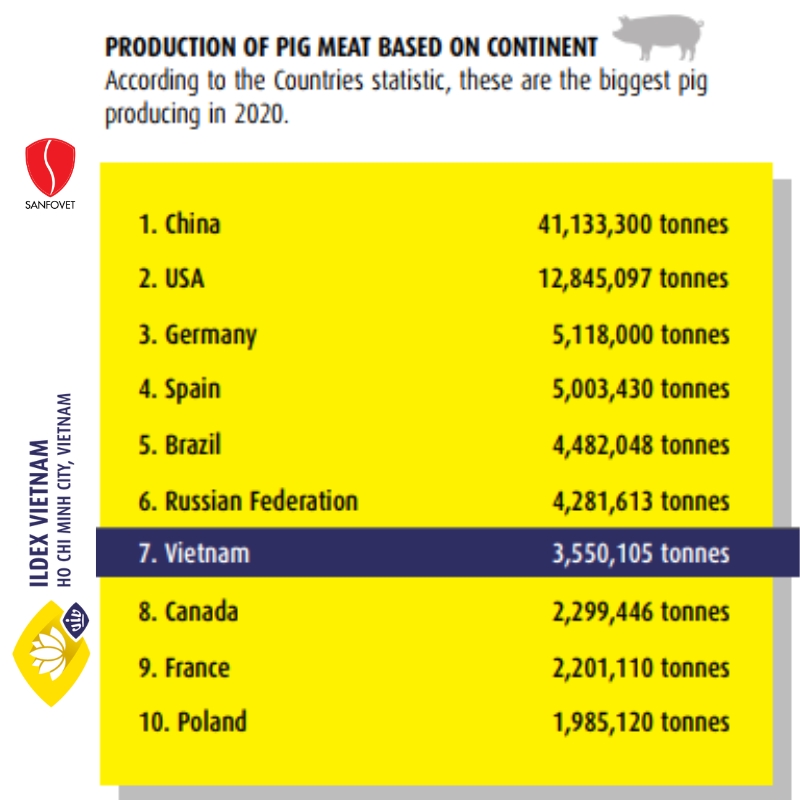

The Department of Livestock Production has set a goal for 2023 to increase the value of livestock production by about 4.5-5.0% compared to 2022. The total meat output is expected to reach about 7.27 million tons, an increase of 4.1%, of which pork meat output will increase by 4.0% and poultry meat by 4.8%; egg production is expected to increase by about 3.8% and milk production by 8.0%.

This demonstrates the Vietnamese livestock industry's determination to overcome challenges and seize opportunities to enhance competitiveness. Additionally, efforts to address intermediary issues and promote the export of livestock products, such as bird's nests and milk, especially to potential markets like China, prove that the industry focuses not only on production growth but also on product quality and added value.

The recognition and signing of the Protocol on veterinary and phytosanitary requirements for exporting bird's nests from Vietnam by China also open up significant opportunities for the Vietnamese livestock industry, contributing to export growth and increasing the value of livestock products.

In conclusion, despite many challenges, the Vietnamese livestock market still shows positive signs and growth potential. This growth stems from boosting domestic production, expanding export markets, and enhancing product value. It's crucial for the livestock industry to continue improving quality, minimizing the impact of diseases, and effectively addressing intermediary issues to better connect production and the market, thereby enhancing competitiveness and sustainable development.

Source: VIV Asia